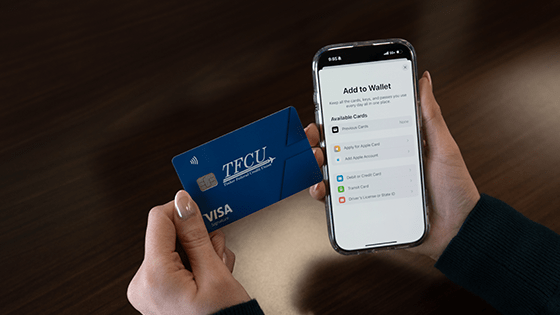

TFCU’s Visa Signature card comes with premier cash rewards

Enjoy the low variable Annual Percentage Rate (APR), higher credit line and no annual fee.

![]() Notice: We are experiencing delays in credit card plastic production. We appreciate your patience as we continue to work with our service provider to deliver your card to you as quickly as possible.

Notice: We are experiencing delays in credit card plastic production. We appreciate your patience as we continue to work with our service provider to deliver your card to you as quickly as possible.

Enjoy the low variable Annual Percentage Rate (APR), higher credit line and no annual fee.

Visa Signature is TFCU’s premier cash rewards credit card. It offers a low variable Annual Percentage Rate (APR), higher credit line and no annual fee. With Visa Signature, and you can expect:

Enjoy an introductory 0.00% Annual Percentage Rate (APR) on purchases & balance transfers (that occur within the first 60 days of account opening) for 6 months from the date of account opening; thereafter, the APR is set by your credit rating at the time of the account opening. After the six month introductory period the APR will be set by the cardholder’s credit rating, ranging from 15.00% – 18.00%. *

*The credit score ranges are as follows: Rate 1 (740 and above) Rate 2 (700 to 739) Rate 3 (660 to 699) Rate 4 (625 to 659) Rate 5 (0 to 624). This information is accurate as of the revision date of 4/1/2025. After the six month introductory period the APR will be set by the cardholder’s credit rating, ranging from 15.00% – 18.00%. Information is subject to change after 4/1/2025. Contact the Card Center at (405) 732-0324, option 6, or 1-800-456-4828, option 6, for questions concerning any changes occurring after the revision date of 4/1/2025.

Spend $1,000 in the first 90 days and receive a $100 introductory reward!

— Earn 3% cash back on dining and fuel.

— Earn 2% cash back on subscriptions and entertainment.

— Earn 1% cash back on all other purchases.*

Shop in the Cash Back Mall and earn additional cash rebates. Merchants within the Cash Back Mall program also offer cash back, special discounts, unique offers and valuable promotions.

*Eligible purchases exclude cash advances, balance transfers, convenience checks, fees, finance charges, cash transactions and disputed or unauthorized purchases or fraudulent transactions.

Get access to ticket pre-sales and sports ticket discounts. Explore your world with incredible travel packages, savings and upgrades. Enjoy premium benefits at a selection of the world’s most intriguing and prestigious properties when you book through the Visa Signature® Luxury Hotel Collection at visasignaturehotels.com. Indulge your passion for wine and complimentary wine tastings at Sonoma County wineries.* Complimentary Visa Signature® Concierge** service is available 24 hours a day. Even receive special offers with many of your favorite brands. For more details, go to visa.com/signature.

*Certain restrictions and limitations apply. Benefits vary at select Sonoma County wineries and are subject to change at any time. Go to visa.com/signature for full details.

**The purchase of goods or services from a merchant in connection with a TFCU VISA Signature cardholders use of Visa Concierge, including any reservations or booking completed by Visa at your request, (“Services”), are solely between you and the respective merchant, and Visa is not a party to the purchase. Goods or services we attempt to purchase on your behalf at your request are subject to availability. You are responsible for payment of any and all charges associated with any Service. See the Visa Concierge Terms of Service for additional terms and conditions.

Full details on these services will be provided with new VISA Signature accounts.

***Service providers supplying emergency roadside assistance and towing are independent contractors and are solely liable for their services. Neither Visa nor Tinker Federal Credit Union shall have any responsibility or liability in connection with the rendering of the service. Emergency roadside assistance and towing may not be available in areas not regularly traveled, nor in other “off road” areas not accessible by ordinary towing vehicles. Weather conditions, time of day and availability of service may affect assistance responses. Expectations for dispatch are set with the customer on every call, and an expected estimated time of arrival is provided to the customer regardless of their location; however, neither Visa nor Tinker Federal Credit Union provides any assurances as to the ability of the Service Provider to meet such estimates. You are responsible for any roadside assistance or towing charges incurred by facilities responding to your request even if you are not with your vehicle or your vehicle is gone upon their arrival. Services provided by United States Auto Club, Motoring Division, Inc.