Teachers + TFCU

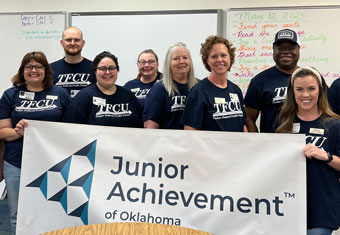

This spring, TFCU hosted its first Teachers + TFCU sweepstakes where we asked our social media followers to nominate their favorite teacher to win $2,000

Together we connect the dots between your goals and the financial services that help you achieve your dreams.

Thank you for your membership, for being a part of something we believe is truly special — for being a member-owner of one of the nation’s most dynamic not-for-profit financial institutions. Every year, this report provides an opportunity for me to share with you not only our financial condition but also our vision. I hope that you, too, embrace this vision for Tinker Federal Credit Union and celebrate our bright future.

People tell me to let the financial statements in this report tell the “numbers story,” but I get to take this opportunity to commend TFCU’s leadership team and board of directors for financially navigating some truly turbulent economic waters over the last two years and coming through this economic cycle with financial strength. In fact, over the last two years, the Federal Reserve has raised rates 11 times in an effort to reign in an overstimulated economy, hoping to curb inflation and return unemployment to more normal levels. I think anyone who has bought anything from eggs to a new car has felt the pinch of rising prices, a phenomenon we haven’t seen in our economy since 2008.

Conditions like these put pressure on our finance team to manage our balance sheet and make prudent decisions about rates. I’m pleased to report a year-end capital ratio over 12%, an indication of TFCU’s ability to weather whatever comes next. You can think of a capital ratio as a rainy-day fund, and our federal regulator considers credit unions with a ratio above 7% to be healthy.

When we talk to members, we know these difficult economic conditions make having a relationship with an affordable, not-for-profit financial partner like TFCU more important than ever. We know this inflation has forced all of us to stretch our household dollars further than ever, with many dipping into savings just to make ends meet. We get it. That’s why we are working hard to offer new financial options like adjustable-rate mortgages and a low-fee, two-year refinance window on most mortgages. It’s why we meet every week to ensure we’re offering some of the most competitive rates and fees in the market. It’s why we try so hard to offer financial coaching and programs when our members find themselves in over their heads.

As you’ve managed your TFCU accounts this year, I hope you’ve noticed our commitment to new technologies. We believe better technology means a better experience for you. Features like contactless debit and credit cards, online card controls, and newer and better ATMs (now interactive teller machines, or ITMs) can make everyday tasks faster and easier. And this is just the beginning. We are looking to provide even more valuable technology tools for you in 2024.

While we know technology is an important part of getting things done, we also know this business we’re in is truly all about people — those we serve, those who work side-by-side with us and those in our neighborhoods and communities. This is our mission. Among many other highlights, TFCU’s financial educators traveled to schools, workplaces and community groups all over Oklahoma to empower more than 27,000 people with the financial know-how to improve their financial lives. To our Choctaw branch, we welcomed Not Your Average Joe, a nonprofit coffee shop providing job training for students and adults with intellectual, developmental and physical disabilities. And, of course, we continue to support the work of the TFCU Foundation, our own nonprofit with a mission to provide necessary assistance to keep veterans in their homes and in their jobs and to empower the first responder community.

As you can tell, we are passionate about providing a best-in-class member experience for you at TFCU. To do this effectively, we need best-in-class employees. COVID made finding, training and retaining talented staff a difficult proposition. That didn’t stop us from working on it over the last few years. In fact, we have a goal to be the workplace of choice in Oklahoma because we know you rely on our people. They have to be the best. TFCU attracts and retains our talent by offering training and career advancement opportunities, plus competitive compensation and benefits. Because of these initiatives, TFCU was named by The Oklahoman as one of the state’s Top Workplaces in 2023.

As we consider what lies ahead of us for 2024 and beyond, we are looking forward with an enormous sense of opportunity. In addition to the initiatives I’ve already mentioned, we are busy developing programs for business owners, we are identifying locations for new branches to serve you, and we continue to advocate for our members’ best interests in Washington, DC, where they continue to signal legislation and regulation that may reduce the income used to provide everyday services at credit unions across the nation. We will stay vigilant on all these initiatives because we know they affect our ability to provide you the best possible experience.

On behalf of the entire TFCU staff and board of directors, thank you for choosing TFCU. We are grateful for your loyalty and confidence in us to reach these goals together. We look forward to taking care of you and your families as, together, we build a credit union strong enough to serve generations to come.

Respectfully,

Dave Willis

President and CEO

2023 checked all the boxes of a great year for making connections! We celebrated the inaugural CU in the Park concert and the final Miracle Car Show. We also gave back to our members and the community through amazing programs, such as the Great Auto Loan Payoff, the College Cash sweepstakes and Teachers + TFCU.

TFCU gave back a total of $156,582 to 1,477 members in 2023 through our Great Member Give Back program. We enjoyed surprising our members with purchase reimbursements, matched deposits and loan payoffs!

On October 14, 2023, TFCU teamed up with local credit unions to present a free country music concert featuring the multi-platinum country music star, Chris Young. CU in the Park took place at Scissortail Park’s Love’s Travel Stops Stage and Great Lawn. The concert drew an estimated crowd of more than 18,000 country music fans from Oklahoma and surrounding states.

“We are excited to bring this free concert to Oklahoma so people can enjoy some great music and discover what credit unions mean in the community,” says Dave Willis, CEO of Tinker Federal Credit Union. “At our heart we are simply people helping people.”

The event began with a simple idea – bring people together for a night of music and fun, celebrating the spirit of community that credit unions embody. In addition to the concert being promoted by participating credit unions, many major television and media outlets covered the event, exposing tens of thousands to the credit union message.

This spring, TFCU hosted its first Teachers + TFCU sweepstakes where we asked our social media followers to nominate their favorite teacher to win $2,000

Tinker Federal Credit Union hosted its 23rd Miracle Car Show on May 6, 2023. Thanks to 137 car entries, sponsors and employee donations, the event

In fall 2023, TFCU gave five lucky Oklahoma students $5,000 each College Cash. Individuals who were 18 years and older and enrolled in an eligible

TFCU is excited to announce the addition of Not Your Average Joe (NYAJ) to the TFCU Choctaw branch, located at 2183 N. Harper. The grand

In 2023, TFCU awarded a total of $66,974.97 to four lucky Great Auto Loan Payoff winners. Each quarter, TFCU randomly selects and pays off a

TFCU was honored to be recognized as a Top Workplace by The Oklahoman for 2023. This is an incredible achievement for the employees on the #TFCUteam who

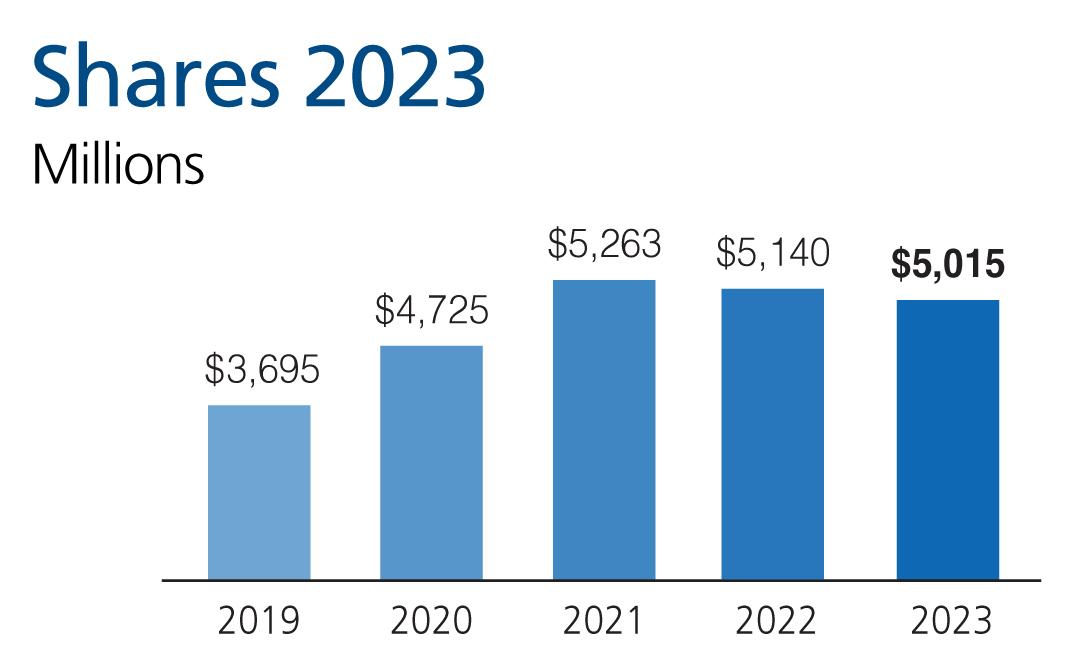

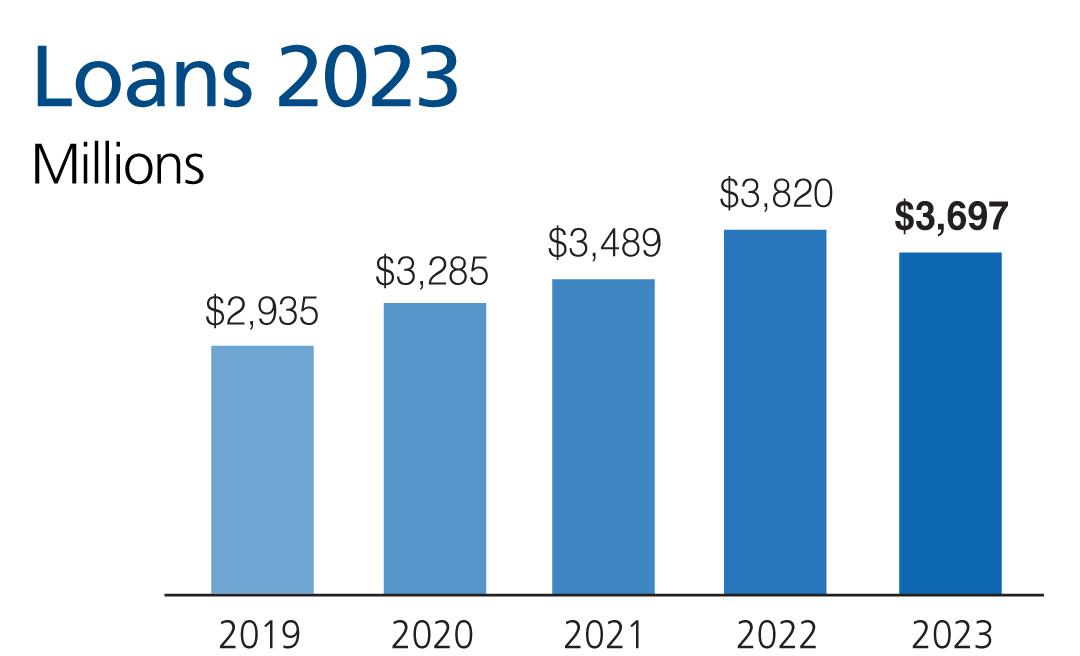

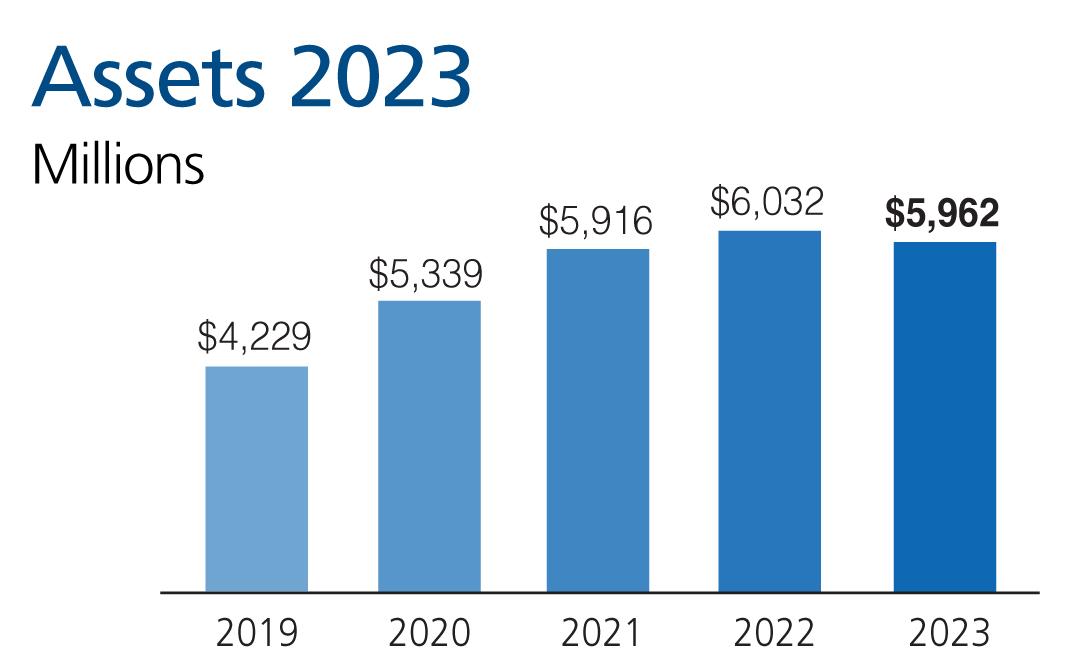

Through careful and experienced financial management, TFCU maintained a strong financial position in 2023 despite continued inflation and an uncertain rate environment.

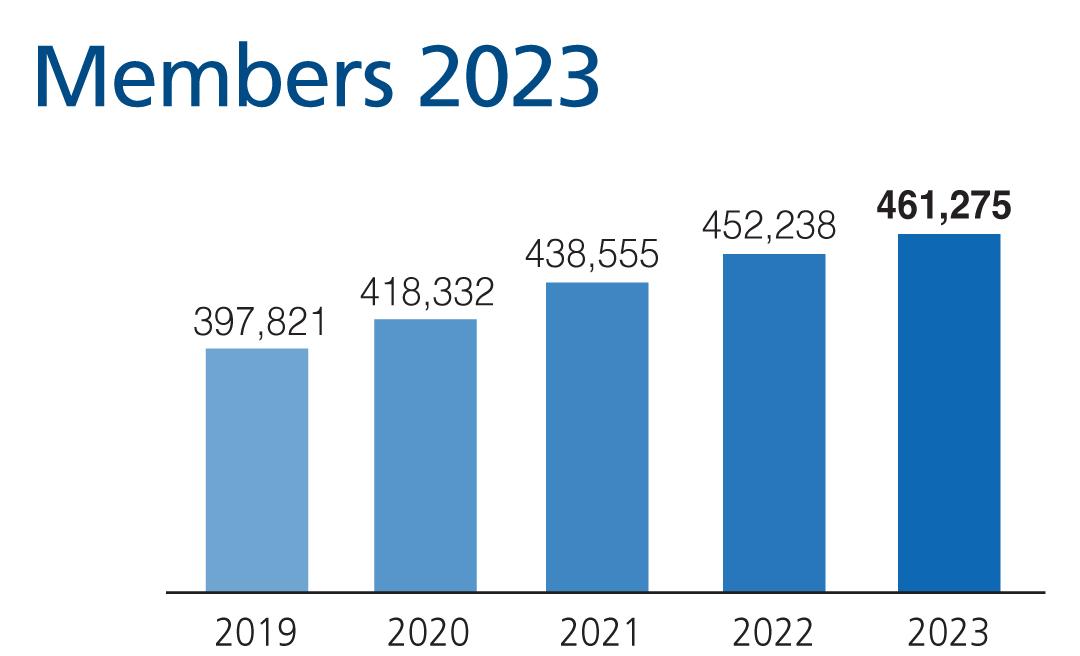

For the 14th consecutive year, Tinker Federal Credit Union’s members voted in The Oklahoman’s Reader’s Choice Awards that TFCU is Oklahoma’s preferred financial institution to trust with their hard-earned dollars. We continue to support Oklahomans as the state’s largest credit union, with nearly $6 billion in assets and more than 460,000 members. While the economy continues to feel the strain of inflation and uncertainty, TFCU remains financially strong.

I encourage you to look closely at the financial statements provided in this annual report. You will find hard evidence of the financial strength of your credit union. Through careful and experienced financial management, TFCU maintained a strong financial position this year despite continued inflation and an uncertain rate environment, ending the year with a net worth ratio of 12.26%, an indication that our rainy-day fund is sound and TFCU is strong.

Part of TFCU’s success over the years has been accomplished through careful, consistent strategic planning. The TFCU Strategic Plan received a major redo in 2023. Part of the implementation includes management’s commitment to communicating with every employee about how their job ties to the strategic plan. The vision is to ensure every employee knows how their job fits in to the “big picture,” they can better help carry out the TFCU mission to help our members.

The board of directors is proud of the hard work from our leadership team, management team and employees. We believe in our mission, “to help our members achieve their goals and realize their dreams.” We are here to serve you, and it is your loyalty that allows us to provide you with the best value concerning your financial needs.

It is now time for me to step down from the board and pass the baton to the next generation of volunteers. It has truly been an honor and privilege to have served the TFCU membership for 27 years. Throughout my tenure, I have remained focused on how each decision made in the board room will affect our member-owners. Thank you for allowing me to serve.

Sincerely,

Gary Wall

Chair, Board of Directors

Gary Wall,

Chair

Tiffany Broiles,

Vice Chair

Eldon Overstreet,

Secretary

Rodney Walker,

Treasurer

Sheila Jones,

Assistant Secretary I

Al Rich,

Assistant Secretary II

James Pearl,

Assistant Treasurer

Whether you’re borrowing or saving, we are here to help.

TFCU has kept your money safe and secure for more than 75 years. We continued to do so in 2023, even as market uncertainty remained a top concern for consumers and at the forefront of discussions among economists. The Federal Reserve has taken steps to slow inflation by increasing rates 425 basis points in 2022 and another 100 basis points in 2023. The stock market has been mixed for the year but ended 2023 with the Dow Jones Industrial Average near a record high. Despite the market and all its challenges, TFCU remained strong.

As travel returns to normal, we are ready to provide you with your next car, boat or RV loan. TFCU continues to have great loan rates and is ready to make your dreams come true, whether you need a home loan, home equity line of credit, credit card or new vehicle. Even with the Federal Reserve increasing rates, TFCU has kept our loan rates competitive in our local market. We also offered certificate specials throughout the year to help our members who wanted to save or were looking for attractive alternatives to the stock market. Whether you are borrowing or saving, we are here to help.

Despite all the challenges the market brought, TFCU ended the year with a return on assets (ROA) of 1.21% and a net worth of 12.26%. These strong financial results mean TFCU will be the credit union of choice as your children and grandchildren find their own path.

You may wonder why a not-for-profit credit union would need net income. Net income is how we increase our equity, which is our rainy-day fund. We encourage you to save money for unexpected emergencies, and we follow that same advice. TFCU sets aside funds (net income) into our rainy-day account (equity) every year. This practice keeps us strong to best serve you no matter what path the economy may take.

It is our honor to help you achieve your goals and realize your dreams.

Respectfully,

Rodney Walker

Treasurer, Board of Directors

Through meticulous examinations of financial statements, policies, procedures and processes, the supervisory committee plays a pivotal role in upholding TFCU’s financial integrity.

The supervisory committee of Tinker Federal Credit Union plays a pivotal role in safeguarding the institution’s safety and soundness, employing a comprehensive approach that involves both external and internal auditors. This multifaceted strategy is crucial for maintaining the financial health and integrity of TFCU ensuring our member can “connect the dots” of their financial goals with safe and sound financial products and services.

External auditors are instrumental in providing an unbiased and objective evaluation of TFCU’s financial statements. These professionals from reputable auditing firms conduct a thorough examination of the credit union’s financial records to ensure accuracy, transparency, and compliance with accounting standards. By scrutinizing the financial statements, the external auditors contribute to the credibility and reliability of TFCU’s financial reporting, fostering trust among members, stakeholders and regulatory bodies.

Internally, the supervisory committee works in tandem with internal auditors to scrutinize policies, procedures and processes within TFCU. Internal auditors, being part of the organization, possess a deep understanding of its operations and are uniquely positioned to identify potential risks and areas for improvement. Through a systematic review, internal auditors assess the effectiveness of internal controls, risk management practices and adherence to established policies. This proactive approach ensures that TFCU is not only compliant with regulatory requirements but also operates with efficiency and prudence.

The supervisory committee orchestrates these audit processes to form a cohesive strategy that addresses various facets of TFCU’s operations. By leveraging the expertise of both external and internal auditors, the committee obtains a holistic view of the credit union’s financial health and operational efficacy. This comprehensive approach is essential for identifying potential vulnerabilities, mitigating risks and enhancing the overall safety and soundness of TFCU.

Moreover, the supervisory committee collaborates closely with these auditors to implement recommended changes and improvements. This iterative process fosters a culture of continuous improvement within TFCU, ensuring that the credit union remains resilient in the face of evolving financial landscapes and regulatory frameworks.

In summary, the supervisory committee’s efforts to ensure the safety and soundness of Tinker Federal Credit Union are characterized by a strategic collaboration with external and internal auditors. Through meticulous examinations of financial statements, policies, procedures and processes, the committee plays a pivotal role in upholding TFCU’s financial integrity, fostering member confidence and meeting regulatory expectations.

Sincerely yours,

Scott White

Chair, Supervisory Committee

Scott White,

Chair

Jim Abbott

Scott Freeman

David Martin

Onekia Smallwood

Brian Watkins