Where’s Save-A-Tron?

During the summer of 2022, you may have seen everyone’s favorite robot out and about in the great state of Oklahoma. TFCU held a fun

Tinker Federal Credit Union exists to help our members achieve their goals and realize their dreams.

Thank you for being a member of Tinker Federal Credit Union (TFCU). You have made the personal decision to be part of a not-for-profit cooperative, where personal service and financial return to our membership are top priorities. We continue to add products and services, add branch locations, and add strong data security for your online and mobile account access. We know you have options for your financial services, and we appreciate your membership.

The last year has brought an economic landscape we haven’t seen for a long time. The tight job market, product shortages, inflation and rising rates have made an impact on everything from the way you manage your home budget to the management of Oklahoma’s largest credit union. You are our member-owners, and we appreciate the trust you’ve shown in us to serve as the stewards of your accounts and loans.

We had a strong year of financing our members’ needs, from auto loans and mortgages to small business loans. The price of these services has increased, though, as the Federal Reserve continues to raise rates to slow down inflation. New deposits were strong in the first quarter of 2022, but as the price of goods climbed, the dollars on deposit shrank. This is a natural reaction to economic conditions, and TFCU has plans in place to stay financially strong while meeting our members’ needs through a changing economic situation.

We strive to provide you a safe and competitively priced option for your hard-earned savings. One piece of that effort over the last year was to offer special share certificate rates. As we all know, when deposit rates increase, so do loan rates. While it is a good time to be a saver, inflation and higher loan rates can put a strain on borrowers’ budgets. TFCU is sensitive to this balance and continues to offer loan rates that are some of the most competitive in the market.

Our strong net worth, coupled with our responsible lending practices, means TFCU is financially stable and will be for years to come.

As a result of careful, responsible financial management, credit unions like TFCU are among the safest financial institutions in America. Media including CNN, the Wall Street Journal, USA Today and the Capitol Hill publication Politico have pointed to credit unions as a safe harbor during troubled times because they avoid the risky lending practices that have brought media attention to the industry lately.

TFCU has a net worth ratio over 11%. To put this into perspective, the National Credit Union Administration, our federal regulator, considers a well-capitalized credit union to have a net worth ratio over 7%. Our strong net worth, coupled with our responsible lending practices, means TFCU is financially stable and will be for years to come.

We continue to be the largest credit union in Oklahoma and have been a strong, safe place for your money since we opened in 1946. We have weathered recessions, booms, busts, the tech bubble, the housing bubble, the pandemic and more. We are still here, keeping your money safe, just like we always have.

TFCU remains financially sound, and our commitment to our membership is as strong as ever. As a member-owned financial institution, we are committed to the safety and security of your money. As we continue to serve you in 2023, we will continue to focus on business decisions that put you, our members, first.

Respectfully,

Dave Willis

President & CEO

TFCU gave back a total of $204,399 to 1,507 members in 2022 through our Great Member Give Back program. We enjoyed surprising our members with purchase reimbursements, matched deposits and loan payoffs!

TFCU held a week-long celebration for the grand opening of its new Norman Southeast Branch in 2022.

In 2022, Tinker Federal Credit Union awarded a total of $92,167 to four lucky Great Auto Loan Payoff winners. Each quarter, TFCU randomly selects and pays off a member’s auto loan, up to $50,000. Watch each of their amazing stories below.

During the summer of 2022, you may have seen everyone’s favorite robot out and about in the great state of Oklahoma. TFCU held a fun

On Memorial Day in 2022, TFCU sponsored an event hosted by The Oklahoma Aeronautics Commission in partnership with the Air & Space Forces Association, Gerrity

After taking a break from special events for TFCU Heritage Club members due to the pandemic, we were excited to see our 55-and- better friends

In the fall of 2022, 24 TFCU employees volunteered their time to teach financial literacy skills to 496 students in kindergarten through 5th grade at

The TFCU Foundation made a huge impact in the lives of Oklahoma veterans and emergency first responders in 2022. More than $100,000 was donated to

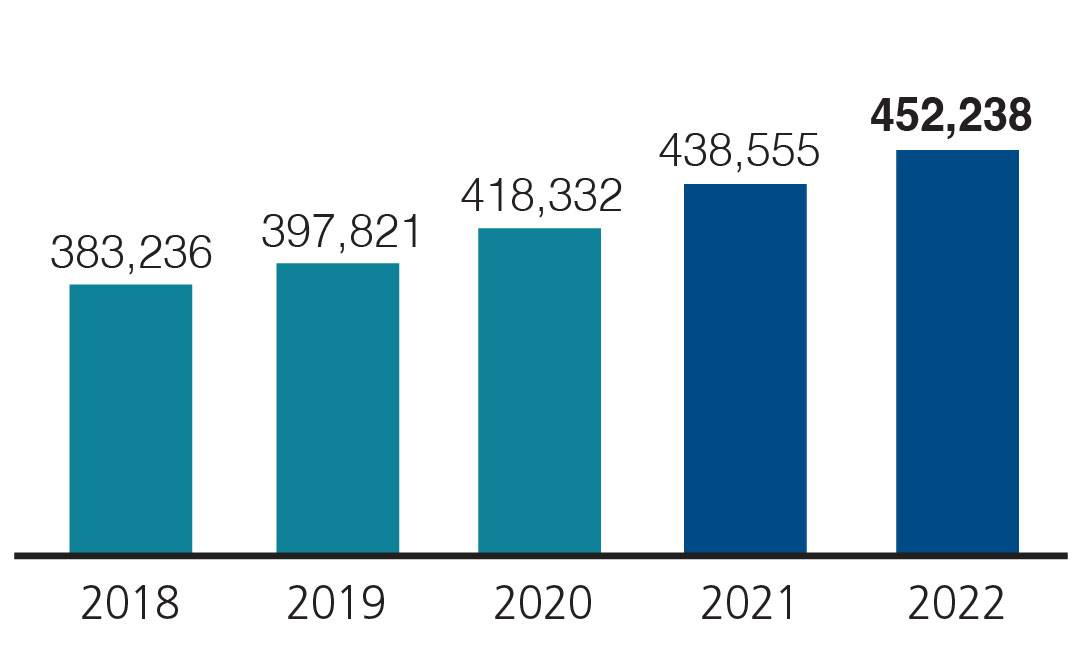

For the 13th consecutive year, our members voted in The Oklahoman’s Reader’s Choice Awards that Tinker Federal Credit Union is Oklahoma’s preferred financial institution to trust with their hard-earned dollars. We continue to support Oklahomans as the state’s largest credit union, with over $6 billion in assets and more than 450,000 members. While the economy continued to feel the strain from the pandemic, TFCU remains financially strong.

I encourage you to look closely at the financial statement provided in this annual report. You will find hard evidence of the financial strength of your credit union. Through careful and experienced financial management, TFCU maintained a strong financial position this year despite continued inflation and an uncertain rate environment, ending the year with a net worth ratio over 11%, an indication that our rainy-day fund is sound and TFCU is strong.

2022 was a year of growth for TFCU. The employment market has been extremely competitive. To ensure a talented employee base that provides excellent member service, we made considerable efforts in becoming one of Oklahoma’s best employers. We spent a great deal of effort examining compensation and related policies to make sure TFCU can attract those who can achieve high standards. Additionally, we opened our Norman Southeast branch in June, replacing the smaller and outdated Norman East branch. The Norman Southeast branch features new technologies, including Interactive Teller Machines (ITMs) and an electric vehicle charging station.

This year of growth began with a transition to a new online and mobile banking platform. This transition set the stage for TFCU’s technology roadmap, an array of innovative technologies we will be able to add to this new platform and to other aspects of our members’ TFCU experience.

The Board of Directors is proud of the hard work from our leadership team, management team and employees. We believe in our mission, “to help our members achieve their goals and realize their dreams.” We are here to serve you, and it is your loyalty that allows us to provide you with the best value concerning your financial needs.

Now comes the time for me to pass the baton to the next generation of volunteers. It has been my honor and privilege to have served the TFCU membership for 36 years. Throughout my tenure, I have remained focused on how each decision made in the Board room will affect our member/owners. Thank you for allowing me to serve.

Sincerely,

Bill Watkins,

Chair, Board of Directors

Bill Watkins,

Chair

Gary Wall,

Vice Chair

Tiffany Broiles,

Secretary

Eldon Overstreet,

Treasurer

Rodney Walker,

Assistant Secretary I

Sheila Jones,

Assistant Secretary II

Al Rich,

Assistant Treasurer

2022 was a year of growth for TFCU. The employment market has been extremely competitive.

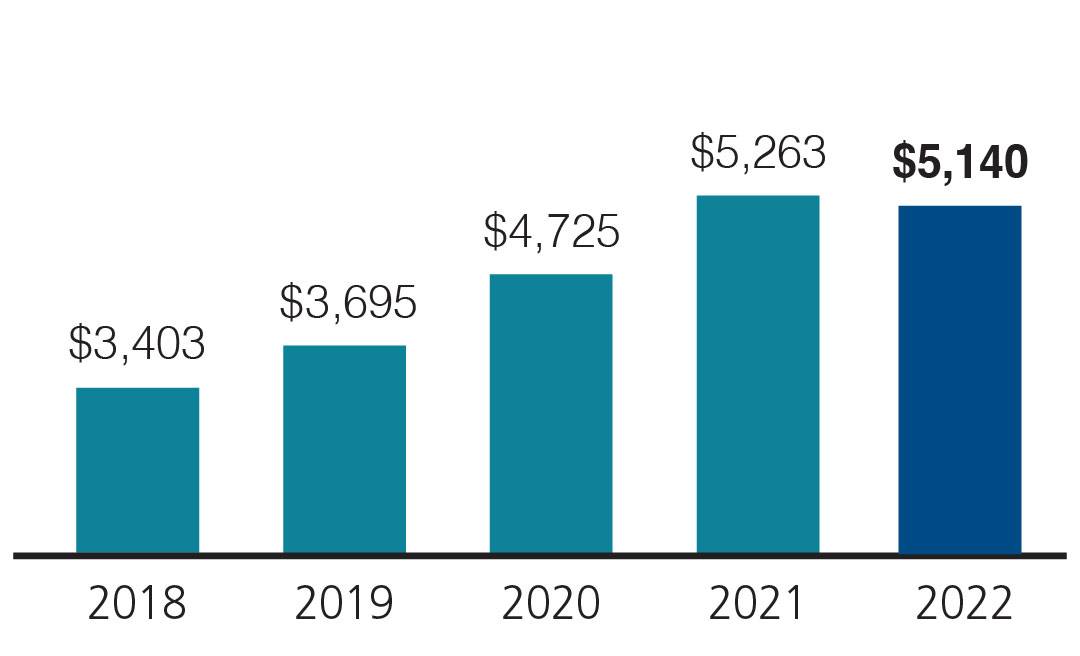

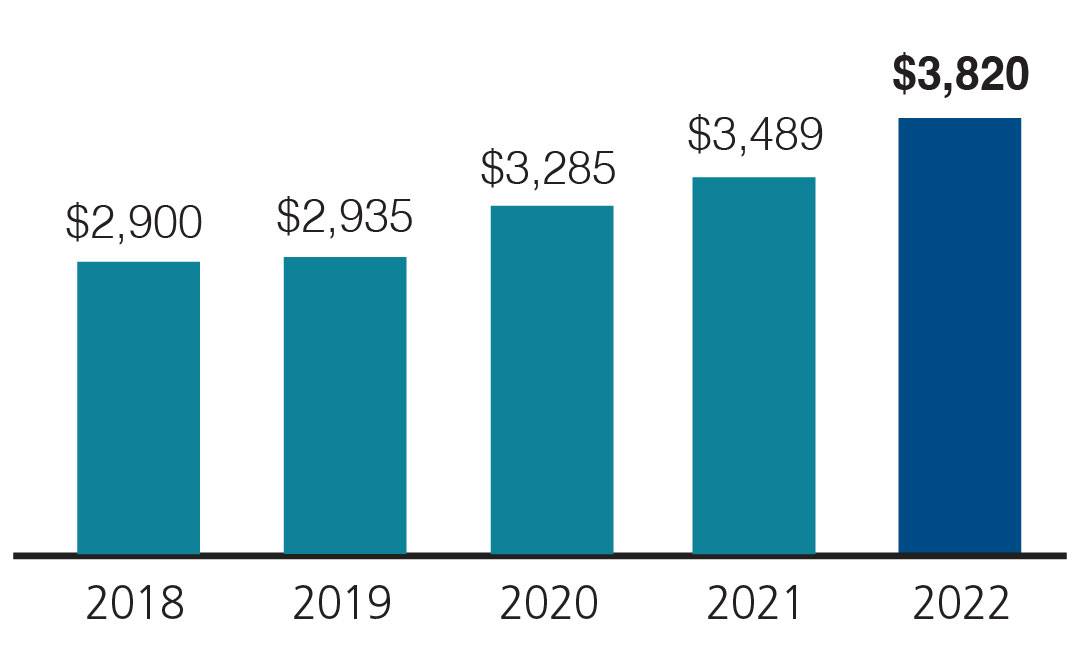

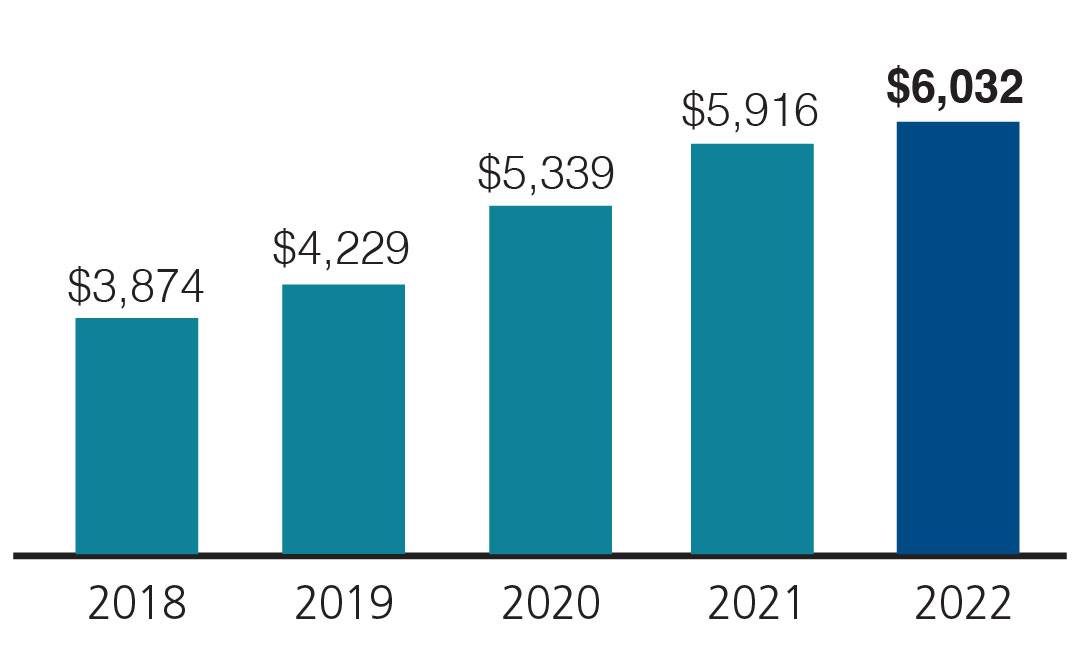

For more than 75 years, TFCU has kept your money safe and secure. And we continued to do so in 2022, even as the markets suffered inflationary pressures. The Federal Reserve took steps to slow inflation by increasing rates 425 basis points or 4.25%. The stock market historically runs inverse to interest rates, but market movements were up and down throughout the year. Despite the markets and all their challenges, TFCU remained strong.

As we all return to normal life activities, we are ready to provide you with your next car, boat or RV loan. TFCU continues to have great loan rates and is ready to make your dreams come true, whether you need a home loan, home equity line of credit, credit card or new vehicle loan. Even with the Federal Reserve Bank increasing rates, TFCU has kept our loan rates competitive in our local markets. We also offered certificate specials throughout the year to help our members who want to save or are looking for attractive alternatives to the stock market. Whether you are borrowing or saving, we are here to help.

Despite all the challenges the economy brought, TFCU ended the year with a Return on Assets (ROA) of 1.22% and a Net Worth of 11.59%. These strong financial results mean TFCU will be the credit union of choice as your children and grandchildren find their own path.

You may wonder why a not-for-profit credit union would need net income. Net income is how we increase our equity, which is our rainy-day fund and is a regulatory mandate. We encourage you to save money for unexpected emergencies, and we follow that same advice. TFCU sets aside funds (net income) into our rainy-day account (equity) every year. This practice keeps us strong to best serve you no matter what path the economy may take.

It is our honor to help you achieve your goals and realize your dreams.

Respectfully,

Eldon Overstreet

Treasurer, Board of Directors

Millions

Millions

Millions

The Supervisory Committee provides the membership with independent monitoring and review of Tinker Federal Credit Union’s management of internal controls, operations and activities. The Committee reviews all audit reports and meets regularly to discuss audit results, Internal Audit recommendations for strengthening internal controls, and the status of management’s action on all prior Internal Audit recommendations.

The Supervisory Committee ensures that TFCU’s financial statements provide a fair and accurate presentation of its financial condition and that management establishes and maintains sound internal controls to protect the assets of your credit union. Overseeing these activities ensures TFCU accomplishes the duties as outlined in its charter. To help with this process, the committee engaged the independent accounting firm of Doeren Mayhew to administer external reviews of control and financial procedures. Based on the results of the comprehensive audit of TFCU’s year-end financial statements, the firm established that Tinker Federal Credit Union continues to be financially strong and well managed, with sound policies and programs.

The Committee takes pride in assuring the continued integrity of TFCU for the membership. TFCU remains strong due to the quality of our members, management, staff and volunteers. We look forward to another year of strength and stability for TFCU.

Sincerely,

Scott Freeman

Chair, Supervisory Committee.

Scott Freeman,

Chair

Scott White

James Pearl